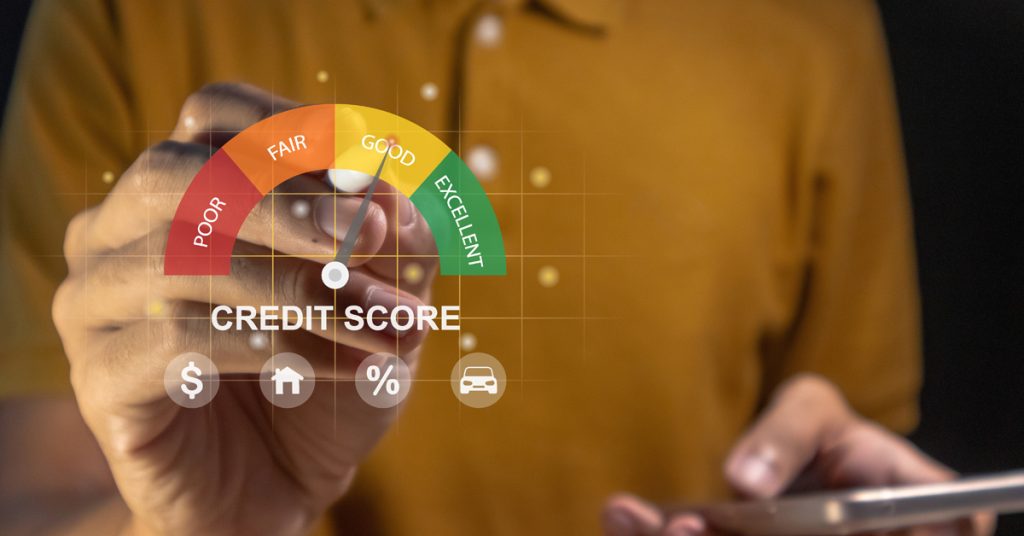

Why CIBIL Score for Home Loan Matters

Your CIBIL score for home loan is like an academic report card that gauges how eligible you are for a loan. Banks use it to judge two things: your potential to repay and your eligibility for what interest rate. A higher score proves you’ve been responsible—think of it as consistent A+ homework. That often means better loan terms and even faster approvals

Minimum CIBIL Score Needed

So, what’s the bare minimum CIBIL score for home loan you need? It varies between lenders, but generally, a score of 650–700 gets you in the game, and anything above 750 is considered excellent. Here’s a quick view:

- A score of 650–700 will likely get a home loan, but interest rates may be higher.

- 700–750 is a comfortable zone, good chances, decent rates.

- 750+ is great standing—fast approvals, lower interest, and more negotiation power.

- Lenders often expect a minimum score of 725 — 750+, unlocking the best deals

How Your CIBIL Score for Home Loan Affects Offers

1. Loan approval odds: A high credit score will show you as low risk for financial institutions, and hence, quick loan approval.

2. Interest rates: Better credit scores can get you better rates. An 800+ might get 8%, while a 650 may get around 9.5%.

3. Sanctioned amount: A high credit score can also get you a higher loan amount. High credit score=low risk, high potential to pay off timely.

4. Faster processing: Approvals are smoother and quicker if your score is high.

Can You Get a Home Loan with a Low Score?

It’s possible, but there are certain conditions. Some financial institutions or small banks might consider scores as low as 650–700, but that comes with-

- Higher down payment

- Requirement for Proof of income or assets

- Requirement of a co-applicant or guarantor

- Higher interest rates and stricter scrutiny

How to Improve Your CIBIL

Did you know that taking your CIBIL score for home loan up by 50–100 points can lower your home loan rate by 0.1–0.3%?. Doing the following can improve your CIBIL drastically-

- Paying EMIs and credit card bills timely—even one delay brings down your score

- Using less than 30% of your credit limit.

- Correcting any errors in your report monthly

- Avoiding multiple loan applications.

- Keeping a mix of loans, like a small credit card and an auto or personal loan.

- Having a steady Income and job stability- Even a 720 score with strong income and low EMIs may perform better on paper than a 780 score with unstable income

Honing Your Financial Health

Before you approach lenders:

- Check your CIBIL report once a month

- Pay off pending dues

- Avoid new credit lines

- Improve and monitor until you hit ~750

To sum up, you must target 750+ for smooth approvals, low interest, and high loan amounts. 650–700 works, but expect more cost and paperwork. Below 650 leaves you with limited lenders, higher costs, and less negotiation power

Your CIBIL score for home loan applications isn’t the only factor determining your home loan eligibility, but it’s important. Think of it like fuel; the better it is, the smoother your journey. Now, you’re not just applying for a home loan—you’re applying with confidence, better terms, and a stronger financial foundation.

FAQs

1. Can a 600 CIBIL score get me a home loan?

It’s tough. A few niche lenders might approve, but expect higher interest rates and more conditions

2. Does a score of 725 work for a home loan?

Yes—725 is often the absolute minimum, but 750+ is ideal for good terms.

3. How much interest difference does a higher CIBIL score for home loan make?

Even a 50-point boost can give you a 0.1–0.3% lower rate, which compounds into big savings over 20–30 years.

4. Will multiple loan applications hurt my score?

Yes, each hard credit inquiry can lower your score slightly, so apply selectively.

5. Can I fix errors in my CIBIL report?

Absolutely—spot any mistakes and file a dispute. Once resolved, your score should reflect cleaned-up data.

6. How soon can I raise my CIBIL score?

Typically, 2–3 months of timely payments can show improvement, not instant, but fast enough.

7. Does a high CIBIL guarantee the lowest interest rate?

Not always. Other factors like income and EMI ratio matter. But a high CIBIL is a strong ticket to negotiate better deals.