For most of us in India, buying a first home isn’t just a transaction. It’s a milestone wrapped in dreams — the kind of thing you talk about with family over chai, plan for years, and celebrate with a housewarming that neighbours remember.

But between the excitement of choosing tiles and imagining the first Diwali in your own living room, there’s a less glamorous but equally critical part — the home loan application process in India.

And here’s the truth: one misstep here can be expensive. Not just in rupees, but in time, peace of mind, and sometimes even in the home itself. A missed credit check. A hasty choice of tenure. Skipping property verification. They sound small until you see the months-long delays or extra lakhs in repayments.

As 2025 brings fresh lending norms, fluctuating interest rates, and faster-but-stricter digital verification, here’s a grounded, real-world look at 10 common home loan mistakes in India — and how you, as a first-time homebuyer, can avoid them.

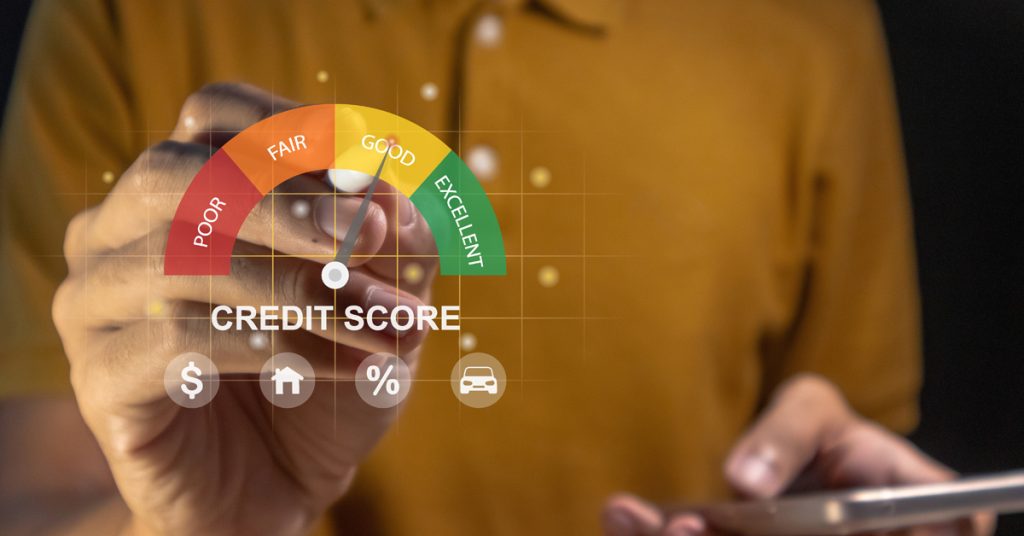

1. Skipping the Credit Score Check

Think of your credit score as your handshake with the bank. Firm and confident, and they’re ready to talk. Weak or patchy, and you’re suddenly in “convince me” territory.

Too many first-time homebuyers in India never check their credit score before applying. Some don’t even know how much weight it carries. Your score not only affects approval chances but also the interest rate you get.

Avoid this by:

- Pulling your CIBIL report at least 3 months before you apply.

- Correcting any errors with the bureau.

- Clearing overdue bills and keeping credit card use below 30% of your limit.

- Avoiding fresh loan or credit card applications in the months before your home loan.

A healthy credit score for home loan approval is often the cheapest way to save lakhs over the life of your loan.

2. Jumping at the First Loan Offer

A bank offering you “the lowest EMI in the market” can be tempting, but a loan is more than an EMI. There are processing fees, insurance costs, prepayment rules, and customer service quality to consider.

Avoid this by:

- Comparing at least 4–5 lenders online.

- Looking at the APR (Annual Percentage Rate), not just the base rate.

- Reading reviews from other borrowers.

- Negotiating for processing fee waivers or better terms.

In 2025, digital comparison tools make this easier than ever — take advantage of them.

3. Picking the Wrong Loan Tenure

A long tenure feels safe now but can mean paying double the cost of your house in interest over time. Too short, and your EMIs eat up all your monthly breathing space.

Avoid this by:

- Using online calculators to compare EMIs and total payouts for different tenures.

- Choosing a balance between comfort today and savings tomorrow.

- Considering your career stage and expected income growth.

Remember, tenure is not just about numbers — it’s about your lifestyle over the next 10, 15, or 20 years.

4. Applying Before You’re Paper-Ready

The fastest way to stall your home loan application process in India is to submit incomplete or outdated documents.

A mismatch in your PAN and Aadhaar, a missing property tax receipt, or outdated bank statements can set you back weeks.

Avoid this by:

- Making a full document checklist before you start.

- Updating all KYC details (address, photo, signature).

- Keeping both scanned and physical copies handy.

5. Overlooking Property Legal Checks

Your home loan is secured against your property. If your property documents have gaps — missing approvals, unclear titles, pending disputes — the bank will back away.

Avoid this by:

- Getting a legal opinion on title deeds and encumbrance certificates.

- Checking municipal approvals and environmental clearances.

- Avoiding any property without a clear, uncontested title.

Property legal checks before a home loan are not just a formality — they are your safety net.

6. Forgetting the Hidden Costs

Many borrowers plan for the EMI and interest but forget about stamp duty, registration fees, home insurance, and even GST on some charges.

Avoid this by:

- Asking for a full cost sheet from your lender.

- Comparing these charges between banks.

- Budgeting separately for one-time and recurring costs.

7. Ignoring Interest Rate Risks

Most home loans in India have floating interest rates. RBI changes policy, and your EMI changes with it.

Avoid this by:

- Knowing your rate type — fixed, floating, or mixed.

- Keeping an emergency buffer for possible EMI hikes.

- Switching to fixed if you value stability over chasing lower rates.

8. Not Making Prepayments

Bonuses, tax refunds, and unexpected gains are perfect for part-prepaying your loan. Many people miss out because they think prepayment is complicated or penalised.

Avoid this by:

- Confirming your prepayment policy before you sign.

- Making even small extra payments early in the tenure — the savings are significant.

- Recalculating your schedule after each prepayment.

9. Skipping Loan Protection

If something unexpected happens — illness, disability, or worse — your family could be left with the EMIs.

Avoid this by:

- Taking term insurance for the loan amount.

- Considering mortgage protection insurance.

- Matching the policy term with your loan term.

10. Rushing Without Advice

The first-time homebuyer tips India needs most? Don’t rush.

Even a short discussion with a certified financial advisor or property lawyer before applying can save you months of stress and unexpected costs.

Avoid this by:

- Asking questions until you understand every term in your agreement.

- Attending webinars or bank Q&A sessions on home loans.

- Using verified brokers or online platforms with transparent reviews.

The Bottom Line

Avoiding these home loan mistakes in India isn’t about making the process complicated — it’s about protecting your money and peace of mind.

Think of it like building your home’s foundation. JK Cement ensures it’s strong and lasting; your careful financial planning ensures you can keep that home without sleepless nights.

Avoid home loan rejection by being prepared, patient, and proactive — and your homeownership journey will be as solid as the walls you build.