Want the Best Home Loan Interest Rates in India? Let’s Break It Down

Applying for a home loan in India can be a daunting experience. If you’ve ever walked out of a bank, clutching a file of documents that could have taken you weeks to curate, you’ve likely wondered: “Is this the best deal I could get?”

Truth is, even a 0.5% swing in interest rate can mean the difference of several lakhs over the loan tenure. So whether you’re a salaried professional, a self-employed contractor, or a civil engineer breaking ground on your own house, understanding how home loan rates work — and how to negotiate them — can help you save big.

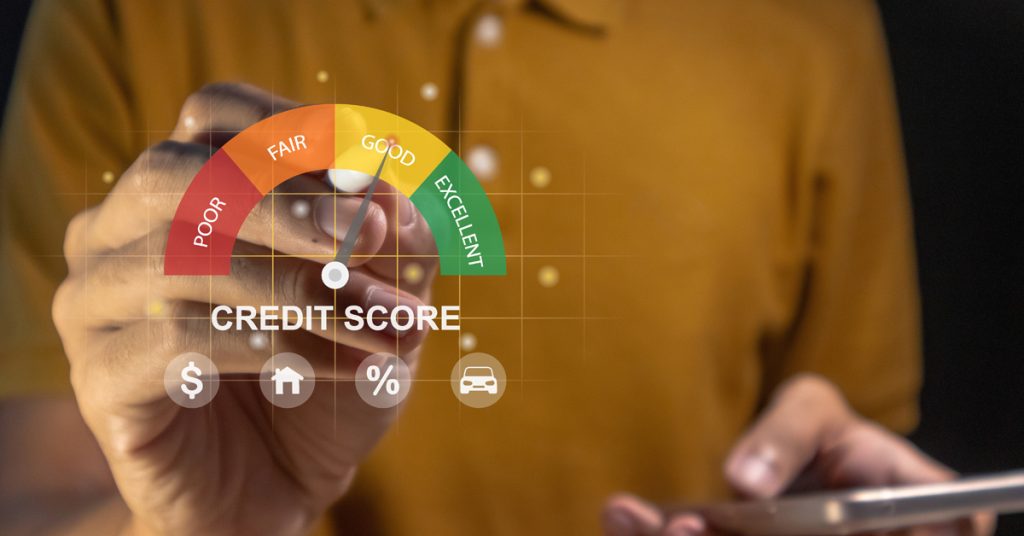

1. Credit Score

Your credit score is more important than you think. It can make or break your home loan application. If your score’s on the lower side, improve it first – clear credit card dues, maintain EMI discipline for 6 months, and check your report for errors before applying.

But before anything else, lenders look at your CIBIL score. Here’s how it usually plays out:

- 750–900: Excellent. You’ll likely be offered the lowest possible rates.

- 650–749: Acceptable, but expect slightly higher terms.

- Below 650: Limited options, with higher scrutiny or potential rejections.

2. Choosing the Right Lender

Different institutions cater to different profiles. Always compare the ‘effective’ interest rate, after adding in processing charges, insurance bundles, and account maintenance.

- Public Sector Banks (e.g., SBI, BoB) – Lower base rates but slower processing and more documentation.

- Private Banks (e.g., ICICI, HDFC) – Speed and service, often at a marginally higher cost.

- NBFCs (e.g., LIC Housing, PNB Housing) – More flexible for self-employed borrowers, but floating rates and fees can vary.

3. Profile Matters

Your profile is determined by how you present your credibility. Keep income proofs, ITRs, Form 16, and salary slips neatly organised. Presentation matters more than you think.

- Salaried professionals with consistent employment — especially in PSUs or MNCs — are seen as low-risk and often receive better rates.

- Self-employed applicants must show strong income stability, clean ITRs for 2–3 years, and audited books. A well-maintained file can go a long way.

4. Women Borrowers’ Advantage

Many lenders offer a 0.05% interest rate concession for women applicants. This isn’t symbolic – it adds up over time. To qualify, the woman must be either a sole or co-owner of the property. This also helps with stamp duty rebates in several states and eligibility for schemes like PMAY.

5. Fixed vs Floating Interest Rate

Whether you pick a fixed or floating interest rate, choose what will suit you long-term. Base it on your goals, financial ability and future challenges.

- Floating Rate: Adjusts with the RBI repo rate. Lower to start and deal when interest rates are falling, but if rates increase, so will your monthly EMI.

- Fixed Rate: Slightly higher initially, but won’t change even if the interest rates are volatile, protecting you from future hikes.

6. Time Your Loan Smartly

Loan rates tend to dip during festive seasons (Sep–Nov) or after RBI rate cuts. If you aren’t in a hurry, keep an eye on the repo rate and bank-led campaigns. A little patience can unlock better terms.

7. Negotiate

Strong applicants can and should negotiate. Loan officers often have room to offer discounts, but only to those who ask. Old and loyal customers are eligible to ask for a waiver on the processing fee.

8. Look Beyond Just the Rate

There are certain costs you may have to incur apart from the percentage of interest such as –

- Processing fees (typically 0.25%–1%)

- Technical/legal verification charges

- Mandatory insurance (often optional — check the terms)

It is wise to ask for an amortisation schedule – it breaks down every EMI into principal and interest components and offers full visibility.

Getting the best home loan rate isn’t just about chasing the lowest number. It’s about knowing your financial health, timing your application, and being prepared to compare — and even walk away.

Whether you’re setting up a home in Lucknow or planning a duplex in Coimbatore, approach the process informed and empowered. A smarter decision today could save you lakhs over the next two decades.

FAQs

1. What’s a good home loan interest rate right now?

For salaried applicants with a decent credit profile, anything between 8.25%–8.75% is competitive.

2. Does credit score really matter that much?

Yes. A CIBIL score above 750 opens doors to better rates. Below 700? You might face higher rates or stricter loan terms.

3. Do women get lower rates?

Yes — most banks offer a 0.05% off for women applicants who are also property owners or co-owners.

4. Are PSU banks always cheaper?

Not always, but often more competitive. Still, private banks might provide better service or faster turnaround. Compare all costs.

5. Can self-employed people get good rates?

Yes, if your ITRs and financials are strong. Clean records and consistent income speak louder than job titles.

6. Should I choose fixed or floating?

Floating is more popular, especially when rates are stable or falling. But if you prefer certainty, a fixed rate is fine, even if slightly higher.

7. Can I negotiate my rate?

Absolutely. Especially if you’ve got a strong profile. A polite comparison with another offer often leads to a better deal.

8. What hidden charges should I watch for?

Processing fees, legal fees, and insurance add-ons. Always ask for a complete cost breakdown before signing.

For salaried applicants with a decent credit profile, anything between 8.25%–8.75% is competitive.

Yes. A CIBIL score above 750 opens doors to better rates. Below 700? You might face higher rates or stricter loan terms.

Yes — most banks offer a 0.05% off for women applicants who are also property owners or co-owners.

Not always, but often more competitive. Still, private banks might provide better service or faster turnaround. Compare all costs.

Yes, if your ITRs and financials are strong. Clean records and consistent income speak louder than job titles.

Floating is more popular, especially when rates are stable or falling. But if you prefer certainty, a fixed rate is fine, even if slightly higher.

Absolutely. Especially if you’ve got a strong profile. A polite comparison with another offer often leads to a better deal.

Processing fees, legal fees, and insurance add-ons. Always ask for a complete cost breakdown before signing.